The theory of asset demand also stresses the function of money as a store of value. This theory elaborates on why individuals demand one asset or a typical portfolio of assets over other alternatives.

What is an Asset?

Asset is a valuable resource that an individual or company owns. It has economic value and works as a store of value.

“An asset is a piece of property that is the store of value.”

Examples of assets include money, stock, bonds, buildings, houses, factories, cars, etc. People categorize assets in many ways based on their underlying characteristics and features. These characteristics and features may include duration, tangibility, requirements, and so on. Therefore, the categories of assets may include financial and nonfinancial assets, current and fixed assets, tangible and intangible assets, necessity and luxury assets, and likely others.

Why People Demand One Asset Over Other Assets?

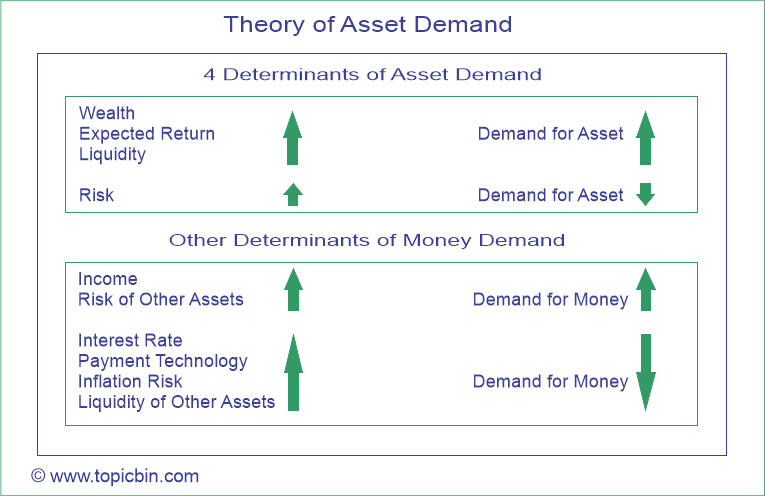

The determinants of asset demand likely provide the answer. There are many versions of the theory of asset demand. However, the crux of all of these theories is more or less the same in that there are four basic determinants of asset demand.

Wealth

Wealth is the total resources, including all assets, owned by the owner. The wealthier the individuals, the more resources they possess to buy more assets. Therefore, an increase in wealth leads to a rise in asset demand.

Expected Return

The expected return of an asset relative to alternative assets over the next period is another key determinant of its demand. Precisely, the rise in the expected return of assets relative to alternative assets leads to an increase in demand for that asset.

Risk

Risk is the degree of uncertainty associated with the return of a typical asset. The higher the risk of an asset, the lower the demand for that asset.

Liquidity

Liquidity is the ease and speed with which one asset is converted into cash. The higher the liquidity of one asset, the greater its demand.

When is the Theory of Asset Demand the Portfolio Theory of Money Demand?

This is when money, as an asset, is demanded. This is why the portfolio theory of money demand is also called the theory of asset demand. The portfolio theory of money demand is a special case of the theory of asset demand because money is the focal asset under demand consideration. The portfolio approach to money demand accepts money as the store of value and elaborates on why money is demanded over other alternative assets in the portfolio.

The portfolio theory of money demand states that people will hold money as part of a portfolio of assets. The amount of money people will demand depends on return and risk on money relative to the risk and return on other alternative assets.

In the figure above, there are 4 determinants of asset demand; all the determinants, except risk, are positively related to the demand for assets, as shown by respective arrows. Likewise, the lower portion of the figure shows the relationships between other determinants of money demand and the demand for money.

Other Determinants of Money Demand

As in the Keynesian theory of money demand, demand for real cash balance is positively related to actual income and negatively related to the nominal interest rate in the portfolio theory of money demand. This is true primarily because of two reasons: First, income and wealth move together; when income is high, there will be high wealth to support a high demand for money. Second, the expected rate of return on money (equivalently, the opportunity cost of holding money) will be high when the interest rate is high, so the demand for real money balance declines.

Now, let’s point out the other determinants of money demand as follows:

Income

There is a positive relationship between income and demand for money. The higher the income level, the higher the demand for money.

Interest Rate

There is a negative relationship between interest rates and money demand. A higher interest rate implies a higher opportunity cost of holding money, which decreases the demand for money.

Payment Technology

There is a negative relationship between the advancement of payment technology and money demand because people need less money to settle the transaction.

Risk of Other Assets

Money demand and the risk of other assets are positively related. When the risk of other assets increases, money becomes relatively less risky than other assets, increasing the demand for money.

Inflation Risk

Investors don’t like to hold money when they perceive inflation risk because money becomes relatively more risky. Instead, they prefer to hold inflation hedges, assets whose real returns are less affected by inflation, to holding money. When they hold Inflation hedges, their real returns are less affected than those of money when inflation rises.

Thus, there is a negative relationship between inflation risk and demand for money.

Liquidity of Other Assets

Currency and checkable deposits are sometimes called dominated assets because investors generally get higher returns on other assets and still feel as safe as money. Moreover, even when the liquidity of other assets rises, money becomes relatively less liquid, so the demand for money falls.

Therefore, the liquidity of other assets and the demand for money are negatively related.

Conclusion

According to the theory of asset demand, the four basic determinants of assets are wealth, expected return, risk, and liquidity. Moreover, the portfolio theory of money demand states that people hold money along with other assets in a portfolio. In line with Keynesian theory of money demand, portfolio theory insists on the function of money as a store of value.

Other determinants of money, a dominant asset, include income, interest rate, payment technology, risk of other assets, inflation risk, and liquidity of other assets.