In this article, we will explain the concept of national income accounting, methods of measuring national income, and problems associated with measuring national income. Before reading this article, we recommend reading and understanding the important concepts of gross domestic product and GDP growth rate.

The flow of this article goes in the following manner.

Concept of National Income Accounting

It is an accounting system that measures economic activities in a logical and consistent framework. National income accounting rests upon the fundamental identity of national income accounting. This very fundamental identity of national income accounting is,

Total Production = Total Expenditure = Total Income

National income accounting shows the relationships among expenditure, income, and production methods of measuring national aggregates. The identity is self-satisfactory because we can consider one’s expenditure to be another’s income if we view it from the national perspective. Similarly, a nation’s output implies its income. The famous classical theory in macroeconomics, Say’s law of the market, provides some sort of rationale behind this logic.

Measurement Methods of National Income

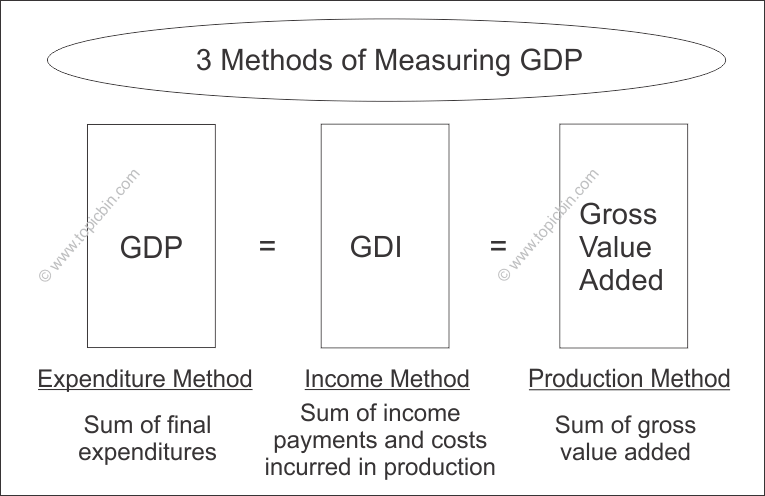

Based on the national income accounting identity, there are three approaches or measurement methods of national income accounting. They are the income method as Gross Domestic Income (GDI), expenditure method as Gross Domestic Product (GDP), and product method as Gross Value Added. These methods are the same and produce the equivalent result subject to statistical discrepancy, mainly from data sources, timing differences, and estimation techniques.

As we know, GDP and GDI are the most famous measures of national income accounting. Definitions and calculation methods center around these measures. The concepts employed in measuring GDP and GDI will also equally apply to measuring other important measures of national income (we will explain later), with slight adjustments to the measures under consideration.

Now let’s explain each of the methods one by one.

Measuring Gross Value Added: Production Method

GDP is the current market value of final products currently produced within the economy. Practically, GDP is obtained as the sum of gross value added by all the industries classified as per the industrial classification system adopted in the economy. As this method sums gross value added by industries, GDP shows the industrial composition of the final output.

Since GDP is the market value, non-market values in the GDP measure are excluded primarily for simplicity. For example, GDP excludes non-market values such as household services, production for self-consumption, and government-provided services (national defense, police protection, firefighting, and education). Similarly, the GDP measure excludes goods and services produced in an underground or black-market economy. These facts result in GDP being an imperfect measure of domestic output.

However, imputed value (an estimate of the equivalent market value of non-traded goods and services) rescues GDP’s imperfection as a domestic output measure. The standard practice for imputed government-provided services is to value them at the cost of providing them.

Now, let’s go through the two methods under the production method of measuring GDP.

Final Product Method

With this method, we can measure GDP by summing up the final value of the outputs of each industry in the economy. However, this method suffers from the problem of double counting while differentiating which one is the final or intermediate product. This final product method is more or less equivalent to the gross output of industries. Note that GDP only includes the value of final products.

Value Added Method

It is the value-added method to find the value of the final product by surpassing the problem of double counting found in the final product method. Under this method, the total value of output minus the cost of intermediate consumption provides the value of the final product. In other terms, GDP is the sum of gross value added by industries. The gross value added of an industry, in turn, is the difference between gross output and its intermediate inputs. Where gross output refers to sales plus other operating income and changes in inventory, intermediate inputs refer to the value of goods and services consumed in production.

Also, note that GDP includes newly produced capital goods inventory investment and change in inventory during a period. In addition, GDP includes final products produced only in the current period but not produced in the previous period. Lastly, GDP takes into account the period in which production takes place, so it is a flow variable.

Measuring GDP: Expenditure Method

Regarding the expenditure method, GDP is the total spending on currently produced final products within an economy. More specifically, GDP is the national aggregate of consumption expenditure, private investment expenditure, government expenditure, and net export. This approach identifies the purchases of goods and services by persons, businesses, governments, and foreigners. Mathematically,

Y = C + I + G + NX

where,

C = consumption expenditure made by the public

I= private investment made by firms

G= government purchase of goods and services

NX = net exports (exports – imports)

Consumption expenditure

Consumption expenditure is also referred to as personal consumption expenditure or consumption, including values of goods and services purchased by persons. Specifically, it includes –

- Consumer durables – goods that last a long time such as automobiles, electronic goods, appliances, and so on.

- Nondurables – short-lived goods such as food, housing rent service, gasoline, clothing, and so on.

- Services – such as financial services, haircuts, medical care, education, air travel, and so on.

Private Investment

Private Investment or Investment is spending on currently produced goods that are used to produce goods and services over an extended period. It includes the following items:

- Nonresidential fixed investment (business fixed investment on structures, equipment, and intellectual property products).

- Residential fixed investment – expenditure by households on new houses and apartments.

- Inventory investment – change in inventory during the accounting period valued at average prices of that period.

We do not include the purchase of existing housing in GDP because it was produced in earlier periods. Housing and apartments are capital goods, so we do not include them in personal consumption expenditure.

Government Purchases

Government consumption expenditures and gross investment is the alternative term for government purchases. This heading consists of two components: current consumption expenditures (spending on goods and services for the public’s sake) and gross investment (spending on fixed assets). Put simply, government purchases or spending fall under this heading.

Net Exports

Value of currently produced goods and services exported or sold to other countries minus the value of goods and services imported or purchased from abroad. Note that exported goods and services must be currently produced within the economy. We also refer to net exports as the trade balance.

Measuring GDI: Income Method

Note that the GDP equivalent measure obtained using the income approach is called Gross Domestic Income (GDI). This method adds up all the incomes domestically received by households and firms, including profits and tax revenue to the government. More clearly, GDI is “the sum of income payments and other costs incurred in the production of goods and services.” Thus, adding up the mentioned five income categories forms the GDI measure based on income method.

Categories of Income for GDI

- Compensation of employees -includes wages and salaries in cash (mainly monetary remunerations), wages and salaries or fringe benefits in kind (such as transit subsidies, meals, and lodging), and supplements to wages and salaries (such as employer’s contribution for pension and insurance) of employees in return for their work. It excludes the incomes of self-employed individuals or proprietors.

- Taxes on production and imports – incomes of government in the form of income tax, sales tax, real estate property tax, excise taxes, customs duties, and so on.

- Subsidies – negative incomes (like expenses) of government paid to households, businesses, and government enterprises; so, it is a subtraction item in the sum.

- Net operating surplus – It is income earned by government enterprises and private sectors from the current production before deducting interest, rent, and other property income. More specifically, it is the sum of the incomes of private enterprises and the current surplus of government enterprises. Again, private enterprises include corporate profits and proprietors’ income (a measure similar to mixed income in SNA 2008).

- Consumption of fixed capital (also depreciation) – It is a loss of value of capital either from wear and tear or from the scrapped value of obsolete capital. We have to add depreciation back to GDI to get gross income. The reason is that one gets the net income of the business by subtracting depreciation. We call the measure net domestic income without adding back the depreciation.

Important Measures of National Income and Product Account

The consolidation of both DGP and GDI and their components make up the Domestic Income and Product Account, which excludes the treatment of net income payments to the rest of the world. Net income payments to the rest of the world are current payments (income paid on investment in domestic assets) to the rest of the world fewer current receipts (income received on investment in foreign assets) from the rest.

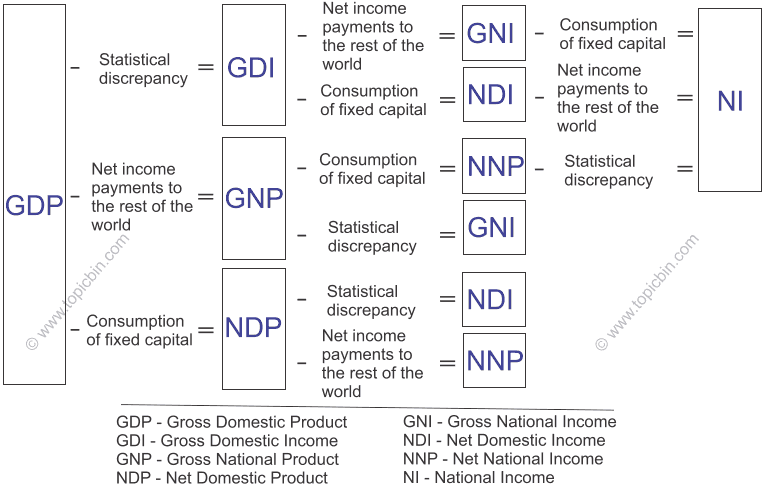

Including net income payments to the rest of the world in the domestic income and product account, which results in the national income and product account (NIPA). GDP and DGI produce consistent and parallel measures; however, due to differences in data sources, timing, and estimation methods, DGP and DGI differ in amount. The difference in amounts of DGP and GDI is a statistical discrepancy.

In addition, GDP amounts to GDI plus statistical discrepancy, which may result from the reliability of expenditure data sources over income data sources. Despite GDP and GDI, there are other important NIPA measures. These measures differ in product or income, gross or net, and domestic or national.

Generally, one can move from one measure to another measure with the following adjustments:

- Product to Income by subtracting statistical discrepancy.

- Gross to Net by subtracting depreciation or consumption of fixed capital (CFC).

- Domestic to National by subtracting net income payments from the rest of the world or adding the net income receipts from the rest of the world.

Relationships Between Important NIPA Measures

Gross National Product (GNP)

GNP is equal to GDP minus net income payments to the rest of the world, or equivalently equal to GDP plus net income receipts from the rest of the world. GNP measures production activities attributable to national residents.

Net Domestic Product (NDP)

It is equal to GDP minus the consumption of fixed capital and measures the output available for consumption and saving.

Gross National Income (GNI)

It is equal to GNP minus statistical discrepancy and measures the income payments earned and cost incurred in the production of GNP.

Net National Product (NNP)

NNP is equal to GNP minus consumption of fixed capital, or NDP minus net income payments to the rest of the world.

Net Domestic Income (NDI)

It is equal to GDI minus consumption of fixed capital, or NDP minus consumption of fixed capital.

National Income (NI)

This is one of the essential measures of national income (NI) and shows how much everyone in the economy has earned. We can get this figure by summing up all the net incomes earned in production. NI can also be referred to as Net National Income. It is also equal to GNI minus CFC, NDI minus net income payments to the rest of the world, or NNP—statistical discrepancy.

Difficulties/Problems in Measurement of National Income

Despite the importance of national income accounting, there are inherent difficulties and problems in the measurement of national income and its components. The difficulties are as under:

- Non-traded transactions—The existence of non-traded transactions prevents the precise measurement of national income. Production for self-consumption, service rendered by housewives, rental income of self-owned houses, and the like are not traded in the market. So, it becomes difficult to determine the market value of non-traded goods and services.

- The problem of double counting—As we know, national income measures include only the final products. However, it is not easy to differentiate final products from intermediate products because the same product can become an intermediate product in one circumstance and a final product in the other. For example, sugarcane is the final product to produce juice, and it is intermediate in sugar production.

- Existence of the black market—Transactions conceded by the government fall under the black market or underground economy. It exists either because the goods and services produced are illegal or the transactions are hidden to avoid tax. If such a market exists, the government cannot figure out how large it is.

- Error in imputation—As the value of non-traded transactions is imputed to provide precise measures of national income, statistical error in estimation results in poor estimation of national accounts.

- Portfolio investment and second-hand transactions—National income accounting does not include portfolio investment and second-hand transactions because they only reflect transactions transferring ownership of already produced goods and services, not additional production.

- Changes in prices—As national income is measured in terms of monetary value, a change in the price of goods and services may result in a change in national income without changing the final products.

- Lack of reliable and adequate data—Reliable and adequate data are the preconditions for perfect measurement of national accounts. However, the availability of such data remains scant in the face of the nation’s underdeveloped state, improper accounting practices, and illiteracy.