This article explains the Keynesian theory of money demand, also known as liquidity preference theory, and elaborates on how it differs from the classical theory.

Assumption of Two Assets World

Keynes assumed the two assets world, where people can hold their entire portfolios either in money or in bonds. They cannot hold portfolios for either of them. Bonds are risky and income-earning assets, whereas money is risk-free assets with virtually no earning.

Even if the balance on bank checking accounts would provide some minimal interest earnings, and holding monetary assets could have costs associated with the forgone interest income, Keynes did not take this into account, considering it an insignificant matter.

Keynesian Foundation for Money Demand

Unlike the classical theory of money demand, which posits transaction motive as the only motive for money demand, Keynes postulates three motives for money demand: transaction motive, precautionary motive, and speculative motive. These three motives are the reasons for money demand, and they serve as the foundation of the Keynesian theory of money demand.

Transactions Motive

In line with the quantity theory of money, people demand money because it is the medium of exchange used to carry out everyday transactions. The demand for money for transactions arises from the needs of personal and business exchanges. The transaction demand for money is proportional to income (as assumed by the quantity theory of money). The relationship between transaction demand for money and income level can be mathematically expressed as

$$L_T = kY \qquad … (i)$$

Where,

LT = Transaction demand for money

k = Fraction of income set aside for transaction purpose

Y = Income level

Equation (i) shows the proportionate and positive relationship between LT and Y. Unlike the value of k in the classical theory of money demand, the value of k in the Keynesian theory of money demand may change due to the changes in institutional and technological factors.

This motive of money demand primarily considers the function of money as a medium of exchange. So, the money demand is for the medium of exchange.

Precautionary Motive

Keynes believed that individuals and businesses hold money as a cushion against unexpected needs. Individuals hold money for unforeseen events like illness, accident, etc., while businesses hold money for unfavorable conditions or to benefit from contingent gains. The precautionary money balance people want to keep will also be directly proportional to their income level.

This relationship between precautionary money balance and income level can be expressed as precautionary money balance function as follows:

$$L_P = kY \qquad … (ii) $$

Where,

LP = Precautionary demand for money

k = Proportion of income for precautionary purpose

Y = Income level

Equation (ii) also shows the proportionate and direct relationship between precautionary demand for money and income level.

Speculative Motive

Keynes believes that people can hold wealth only in two forms of assets – either all in money or all in bonds. One of the important functions of money is the store of wealth, and people’s choice to hold money as a store of wealth is the speculative motive of money demand.

In Keynes’s analysis, the definition of money includes currency and bank deposits on checking accounts. Currency earns no interest, while bank deposits on checking accounts typically earn little interest. That’s why Keynes assumes money earns no interest, and its opportunity cost is the nominal interest rate that would have been earned by investing in bonds. Hence, the speculative motive of money demand is the function of the nominal or market interest rate.

When the nominal interest rate on a bond rises, the opportunity cost of holding money also increases. This makes the holding of money costly in comparison to bonds. Consequently, the quantity of money demanded falls. Similarly, when the interest rate on a bond falls, the opportunity cost of holding cash and, thus, the quantity of money demanded rises.

This implies that there is an inverse relationship between interest rate and the quantity of money demanded. This inverse relationship between interest rate and money demand can be shown mathematically as follows:

$$L_S = f(\frac{1}{i}) \qquad … (iii) $$

Where,

LS = Speculative demand for money

f() = Functional relationship between interest rate and speculative demand for money

i = Nominal interest rate, or current market interest rate

Equation (iii) shows the inverse relationship between interest rate and speculative demand for money.

Keynesian Money Demand Function

Keynesian money demand function is the relationship between money demand and factors affecting it. To Keynes, transaction and precautionary motives for money demand are highly income elastic but interest inelastic; the speculative motive for money demand is interest elastic at the high interest rate. Therefore, these three motives of money demand serve as the collective determinants of the liquidity preference function or Keynesian money demand function.

In addition, money demand is the demand for real cash balance primarily for two reasons: First, people hold cash balance for transactions and precautionary motives to serve the function of money as a medium of exchange. Second, when the price rises, people hold more cash to maintain the same purchase level. Therefore, we can assume that money demand depends on real income rather than nominal income.

Similarly, the real demand for money arising from speculative motives is dependable on the nominal interest rate. This is because the opportunity cost of holding money is expressed in terms of the nominal interest a bond can earn.

Therefore, there are two basic determinants – nominal interest rate and real income – of real money demand function in Keynesian analysis. Mathematically, the real money demand function can be presented as:

$$L = f(i, y) \qquad … (iv)$$

L is real money demand, i is nominal interest rate, and y is real income. The real demand for money is negatively related to the nominal interest rate and positively related to real income.

Keynesian Liquidity Trap

What is a liquidity trap?

The liquidity trap in the Keynesian theory of money demand is a situation wherein the money demand function becomes perfectly elastic at a very low interest rate. That means people hold their real cash balance when interest is very low. In other terms, a liquidity trap is a paradoxical condition where people save too much when interest is too low. Consequently, the real money demand function becomes flat at a low interest rate, and the money supply is ineffective in changing the interest rate.

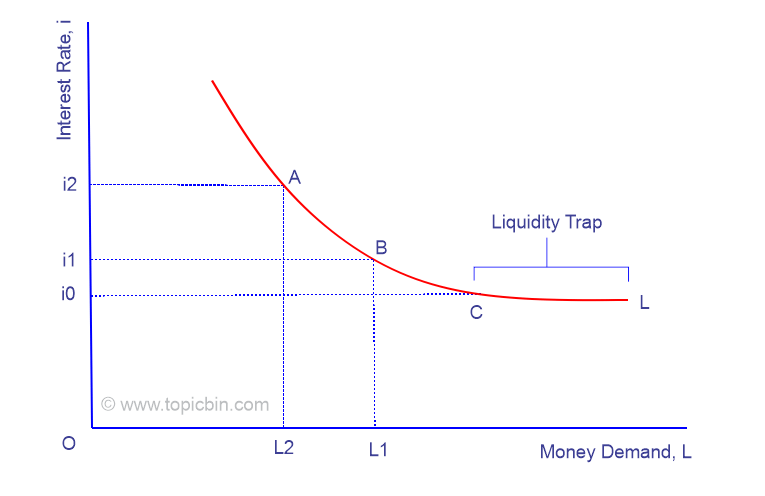

The negative relationship between real money demand and nominal interest rate can graphically be illustrated as:

As you can see in the figure, when the interest rate rises from i1 to i2, demand for money decreases from L1 to L2. In contrast, demand for money will increase for any decrease in interest rate to a certain level, say i0. The downward-slopping red line, L, is the real money demand function, which is flat for any interest rate below i0. So, the CL portion of L is the liquidity trap, wherein people hold their assets all in money, and monetary policy becomes ineffective in altering the interest rate.

Keynesian Money Demand Function in Money Market Equilibrium

When the money market is in equilibrium, the total demand for money (liquidity preference) equals the total money supply. In equation (iv), L is real money demand; therefore, the equilibrium condition in real terms will be $$L =\frac{M}{P} \qquad … (v) $$

where P is the price level, M is the total nominal money supply, and M/P is the total real money supply, which is assumed to be fixed by the central monetary authority.

Now, let’s combine equation (iv) and (v) to get,

$$\frac{M}{P} = f(i, y) $$

Rearranging the the equation, we get:

$$\frac{P}{M} = \frac{1}{f(i, y)} $$

Again, let’s multiply on both sides by real income, y, to get the value of the velocity of money as explained in the classical theory of money demand.

$$V = \frac{Py}{M} = \frac{y}{f(i, y)} \qquad … (vi)$$

We know the demand for money and nominal interest rate are negatively related. Therefore, in equation (vi), raising i means declining f(i, y), and declining f(i, y) means increasing the velocity of money, V. That means the velocity of money is not constant in the Keynesian theory of money demand as opposed to the classical theory of money demand.

Implication of Keynesian Theory of Money Demand

As the interest rate is highly volatile, it leads to the volatile velocity of money. This is an essential implication of the Keynesian theory of liquidity preference. Hence, the Keynesian theory of liquidity preference contradicts the proposition of the classical theory of money demand, which assumes the constant velocity of money. Further, the Keynesian theory of income, thus, casts doubt on the classical theory of income that the supply of money solely determines nominal income.

When the interest rate is too low, or the economy is in a liquidity trap, monetary policy should not target the money supply to achieve its goal.

Criticism of Keynesian Theory of Money Demand

The assumption of two world assets, in which the entire portfolio is kept either in cash or bonds, is unrealistic. Individuals maintain their portfolios with cash, bonds, and other assets.

James Tobin proposed a theory of money demand, pointing out that even transactions and precautionary demands for money would also be interest rate elastic and negatively related to interest rates.