The efficient market hypothesis is an important theory in finance. This article attempts to explain the hypothesis, its different forms, the paradox, and its implications.

What is the Efficient Market Hypothesis?

What are the different forms of efficient market hypothesis?

Paradox of Efficient Market Hypothesis

What are the Economic Implications of Inefficient Market?

What is the Efficient Market Hypothesis?

The efficient market hypothesis postulates that the price of a security (stock and debt) reflects all available information. Hence, no market participant can gain abnormal benefits from trading that security. In other words, any set of market information does not help market participants earn abnormal benefits. In this situation, market participants cannot identify the under-valued and over-valued stocks. This situation results from rapid information adjustment so that nobody can beat the market.

When a market is perfectly efficient, the following things should happen:

- Any information is universally available to all investors presumably at a minimal cost.

- The current security price reflects all available relevant information.

- Only when new information becomes available, does the security price change.

After Eugene Fama’s pioneering research (1965), capital market efficiency emerged. Fama formalized the proposition as an ‘efficient market hypothesis,’ widely accepted as information processing efficiency.

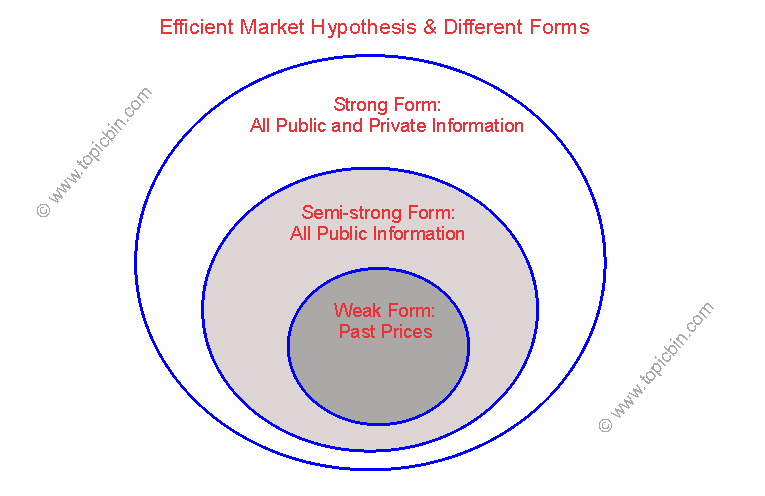

Based on the information processing speed, there are three forms of efficient market hypothesis – weak, semi-strong, and strong. These differences occur from the notion of what is meant by the term “all available information.” There are three serially higher-ordered sets of available relevant information. They are past prices, publicly available information, and all publicly and privately available (insider, confidential, or privileged) information. These sets of information categorize the different forms of efficient market hypothesis.

Weak Form of Efficient Market Hypothesis

The weak form of the hypothesis asserts that current security prices reflect all previous prices, i.e., past prices. Equivalently, the current price of a stock is solely determined by the technical analysis of past prices. Technical analysts and chartists observe past price movements and cyclical trends to repeat themselves but can never beat the market, provided that the market is efficient in weak form. Chartists fail to beat the market because the information processing is so fast that all investors quickly know the significant movement in current security prices relative to past prices.

Put another way, technical analysis of past security prices cannot help predict its current price. According to previous prices, the adjustment in the current price is virtually instantaneous. Hence, the technical analysis of previous prices cannot help investors gain the expected benefits.

Semi-Strong Form of Efficient Market Hypothesis

The semi-strong form states that it is not only the past prices of securities that determine current prices but also the publicly available information. Publicly available information includes the firm’s data on its product line, balance sheet, income statement, earning forecast, patents held, quality of management, etc. In semi-strong form, current prices of securities incorporate the past prices as well as publicly available information. This is where fundamental analysis comes into play. The fundamentalist studies the firm and its business based on past prices, current performance, and prospects relative to external environmental factors.

However, if the market is efficient in the semi-strong form, fundamental analysis of the publicly available information will be valuable in gaining abnormal benefits. Yet, given that the market is efficient in weak form only, fundamentalists can outguess technical analysts.

Strong Form of Efficient Market Hypothesis

This hypothesis contends that security price fully reflects all information, including past prices and publicly and privately available information. Here, privately available information refers to information available only to company insiders, i.e., confidential or privileged information. No investor can get higher benefits than by holding a randomly selected portfolio of individual securities because no one investor has monopolistic access to confidential information. In other words, a strong hypothesis claims that all market participants know even the insider information equally.

In the strong form of efficiency, the security price should reflect its intrinsic value based on the future expected returns and the degree of risk.

Not all these forms of hypotheses are independent, but they are dependent and serially higher ordered in degree of efficiency. Semi-strong market efficiency encompasses weak market efficiency because the sequence of previous prices is one form of public information. Likewise, for the market to be efficient in the strong form, it must also be efficient in the weak and semi-strong forms. Otherwise, the stock price does not reflect all the available relevant information.

Note that the figure above reveals the same ideologies, in which sets of information are subsets of the following successive higher-ordered sets but not the independent sets themselves.

Counter Arguments

However, investors do not always act rationally; they sometimes speculate. Neither the market is perfectly efficient, nor is information freely available (or presumably at low cost). Trade barriers do exist, and everyone cannot borrow and lend the funds at the same rate of interest. To sum up, frictions exist in the market, making it imperfect.

That is why the regulatory body prevents insiders from profiting by limiting their trading in securities. Corporate officers have access to insider information long before it is made public, enabling them to profit. Insiders, their relatives, and any associates who trade on information supplied by insiders are considered to violate the law, and this situation pertains especially in an inefficient market.

Paradox of Efficient Market Hypothesis

The paradox underlying the efficient market hypothesis is that the market should be inefficient for it to be efficient. Only if investors disbelieve the market’s efficiency do they try hard to gain confidential and superior information to beat the market. If investors abandon these efforts, the market’s efficiency will decrease substantially. This effort ultimately works as fuel to keep the market efficient by manipulating investment strategies.

In an efficient market, price movement is random. The randomness of stock prices requires that the transaction cost be zero, all available information to all investors be free, the market be large and liquid, investors have sufficient funds to take advantage of inefficiencies, all participants have the same time horizons and expectations about prices, all participants believe they can outperform the market, etc. If all the aforementioned facts exist, we can consider the hypothesis of an efficient market.

What are the Economic Implications of Inefficient Market?

Let’s present the following implications in light of the inefficient market hypothesis:

Implication for Investors

Given the inefficient market, investors can develop profitable investment strategies if they do a proper analysis. That is to say, they could be better off by adopting a strategy that aims to outperform the market rather than a “buy and hold” one. The technical help taken from the technical analyst benefits the investors. This fact highlights the significant importance of the technical analyst and managers of mutual funds in stock evaluation.

Implication for Portfolio Managers

Given the inefficient market, portfolio managers should engage in the active management approach, in which managers involve themselves in finding undervalued or overvalued stocks, to assets management rather than follow the passive management approach, which aims only at establishing a well-diversified portfolio of securities without attempting to find undervalued or overvalued stocks.

Implication for Policy Makers

Given the inefficient market, an efficient market hypothesis has important implications for policymakers in understanding resource allocation and formulating appropriate plans and policies. Deviations from efficiency may offer profit opportunities to better-informed traders at the expense of less-informed traders. An inefficient market is likely to increase the unequal distribution of income. The misallocation of resources can backtrack the overall economic development process.

Market inefficiency bears the cost of inefficient resource allocation, making it undesirable and inhibiting the benefits of a market economy. Therefore, it is relevant for policymakers to seek ways to enhance market efficiency by providing a practical regulatory framework and implementing it so that the market can better reflect the accurate picture of the economy.

In contrast to an inefficient market, an efficient market provides ready financing for worthwhile business ventures and drains capital away from poorly managed or obsolete product-producing corporations. It reduces the unequal distribution of resources, thereby reducing income inequality. An efficient market attracts foreign investment, boosts domestic savings, and improves the pricing and availability of capital.

If you want to know the calculation process of capital market index, NEPSE, then read this article.