In economic literature, we consider profit maximization is the main goal of any business firm or a rational producer. When we talk about the profit maximization objective, we are implicitly referring to the economic efficiency rather than technical efficiency. Technical efficiency does not consider the financial aspect of production; it only considers technical or engineering aspects of production like we did in study of production function and isoquant.

In this post, we shall go through the case of single-product firm and deal with constrained and unconstrained profit maximization decisions facing a business firm. For the case of multi-product business firm you can read here.

Constrained profit maximization of a single-product firm

Every producer must take production decision regarding what to produce and how to produce? The production decision not only depends on available production function (or technology) but also depends on the relative prices of factor inputs.

Due to the presence of technical and financial limitations in short-run, producer has to make constrained profit maximization decision with the limited resources available at hand. In such a case, producer can either maximize output (equally means revenue maximization given the price of a product) for a given cost outlay (financial constraint) or minimize cost for a given level of output in order to maximize the profit (consider a situation in which a contractor has to make a given building minimizing his total cost).

However, if a firm is new or in long-run it does not face technical and financial limitations. It is unconstrained and free to choose the optimal way of expanding output so as to attain its profit maximization goal.

We can analyze the optimization problem with the help of two important tools – insoquant curve and iso-cost line. Isoquant represents the technical constraint whereas iso-cost represents financial constraint. For more about isoquant, please read this.

What is iso-cost line?

Iso-cost line is the locus of all factor combinations that a produce can purchase with the given outlay or budget. In other words, it shows the combinations of capital and labor that a firm can purchase with given outlay or budget. We can present iso-cost line mathematically as,

C = r.K +w.L

where, C is outlay, r is rental price of capital, w is wage to labor, r.W and w.L are total payments made to capital and labor respectively.

The more portion of total outlay goes to labor, the flatter the iso-cost line will be and the vice-versa. And, if entire portion of outlay goes to labor than the iso-cost line reconciles with the labor axis. Similarly, the more portion of outlay goes to capital the steeper the iso-cost line will be and vice versa. If entire portion of outlay goes to capital than iso-cost line will reconcile with capital axis.

Also note that successively higher level of iso-cost line represents corresponding higher level of outlay. Remaining unchanged the prices of factors, increase or decrease in outlay shifts iso-cost line parallel upwards or downwards. Similarly, remaining unchanged the outlay and price of one factor (say, capital), increase or decrease in price of another factor (say, labor) rotates iso-cost line making steeper or flatter. The slope of iso-cost line is given by the ratio of factor price, w/r.

What are the underlying assumptions?

Let us point out the main assumptions of theory:

- Objective of the firm is profit maximization.

- Modern form of production function with two variable inputs – capital and labor- is considered to apply i.e. Q = f (K, L).

- Prices of factor inputs and product remain constant at least during the analysis.

- Technology of production remains same throughout the analysis.

- Firm produces only a single-product.

How a rational producer minimizes outlay for given level of output?

Given the output level (or isoquant) and its price, total revenue of typical producer is also given as constant. In order for profit maximization, producer must minimize his total cost of producing that particular good. Because the higher the positive gap between total revenue and total cost, the higher the profit of a producer. So, the job of rational producer here is to find the least-cost combination of factor inputs that minimize total cost of production. A rational producer can find that least-cost or minimum cost combination of factor inputs that maximize his total profit fulfilling the following two conditions:

- MRTSL,K = MPL/MPK =w/r (i.e. slope of isoquant curve = slope of iso-cost line)

- Isoquant curve be convex to origin (i.e. marginal rate of technical substitution must be diminishing)

Rearranging the terms in above equation, we get

MPL/w= MPk/r.

This is also the equivalent condition for least-cost or optimum combination of factor inputs. That means to say, for profit maximizing least-cost combination of factor inputs, the ratio of marginal physical product of factor inputs to its price must be same for all factors.

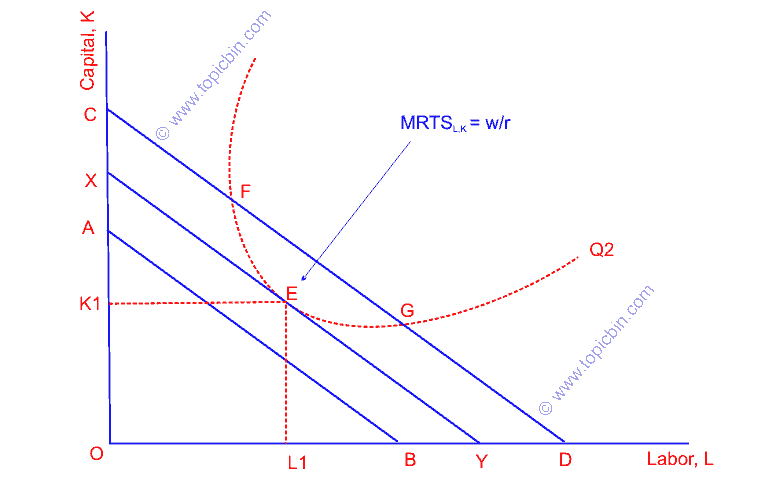

Pictorial presentation of least-cost combination of factor inputs

In figure, producing at points F & G of isoquant Q2 require higher outlay represented by iso-cost line CD, which is inefficient use of resources that cannot minimize the cost outlay. While points below the isoquant curve represents the smaller outlay, which cannot produce the given the fixed level of output. This way, point E is the only possible least-cost combination of inputs, which uses OL1 amount of labor and OK1 amount of capital producing given level of output Q2.

What if isoquant were concave? Producer would result in corner solutions using only one of two factor inputs at lower level than before. But, our consideration is that factors are not perfect substitute and marginal rate of technical substitution diminishes, which rules out the possibility of concave shape of isoquant.

How a rational producer maximizes output for a given level of outlay?

Given the constant price of a product, output maximization equally means revenue maximization from that product. Just like the least-cost combination of inputs, rational producer maximize his output for a given level of outlay fulfilling the under mentioned conditions:

- MRTSL,K = MPL/MPK =w/r (i.e. slope of isoquant curve = slope of iso-cost line)

- Isoquant curve be convex to origin (i.e. marginal rate of technical substitution must be diminishing)

The only difference here is, producer tries to maximize output rather than minimizing cost. This is only an alternative approach to maximization problem, and the ultimate result is same as profit maximization.

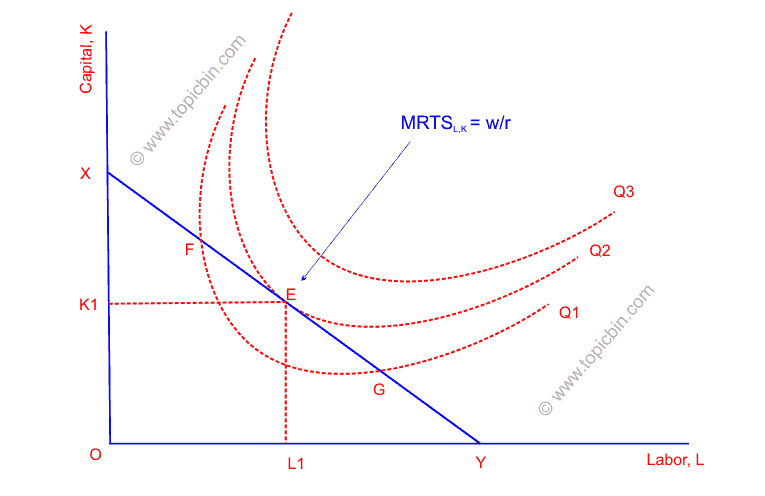

Pictorial presentation of output maximization

In figure above, any points above E are desired higher level of outputs but unattainable because of limited outlay. Similarly, points on iso-cost line XY (other than E) or below it are undesired lower level of output. For instance, producing at point F yields lower level of output Q1, which is not the efficient use of available resources. Therefore, only point E is the point of equilibrium (a profit maximizing condition), in which producer produces Q2 level of output employing OL1 amount of labor and OK1 amount of capital.

Thus in either case of profit maximization, a producer or a firm attains his equilibrium (maximum profit) employing the factors in such a way that equates the slope of isoquant curve to slope of iso-cost line. In other terms, firm should use factor inputs equalizing the additional output obtainable from using another dollar on capital to additional output obtainable from using another dollar on labor.

Unconstrained profit maximization of a single-product firm

Unlike short-run, producer does not face constraints (financial and technical) in long-run, because long-run is a time period in which everything is supposed to change. This way, a firm aims to choose the optimal path of output expansion in order to maximize the profit.

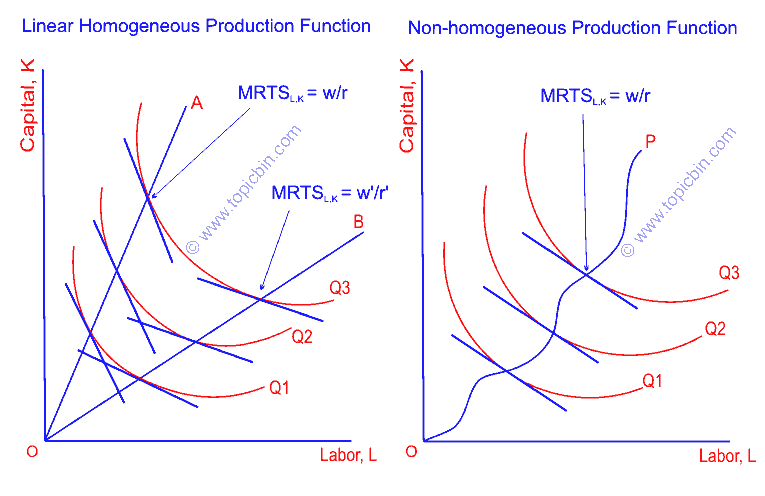

The optimal path of expansion is the locus of point of tangency of successive isoquants and successive iso-cost lines. If the production function is linearly homogeneous, then the expansion path will be straight line passing through the origin. In the figure below, OA is the expansion path when ratio of factor price is w/r. Along the line OA, slopes of iso-cost lines and corresponding isoquants are constant. The ratio of factor prices determines the slope of expansion path OA.

When the ratio of factor inputs increases to become w’/r’, then the expansion path will be flatter OB. Likewise, decrease in the ratio of factor inputs steepens the expansion path.

If the production function is non-homogeneous, the expansion path will not be straight line. It will be a curve OP along which the equilibrium takes place equalizing the slopes of iso-cost lines and isoquants.